The expanded Child Tax Credit is expected to lift 4 million children out of poverty. But that can only be accomplished if low- to moderate-income families are aware of this resource and what they need to do to receive support.

The IRS began issuing the first-ever monthly installments in July 2021. Under the American Rescue Plan, families can choose to receive monthly payments in place of an annual lump sum. This change will help families cover real-time expenses throughout the year.

Here are the details nonprofits and families need to know about to receive monthly payments:

- $3,000 – $3,600 per child is available to nearly all families.

- You can receive the Child Tax Credit even in you have no income for 2019 or 2020.

- If you don’t typically file taxes, families need to file 2020 taxes or register with the IRS to receive payments.

- Families will automatically receive half of their credit in monthly payments from July to December, and the other half when they file taxes in 2022.

- When providing banking information to the IRS to receive payment, families may be able to have it added to an existing prepaid card.

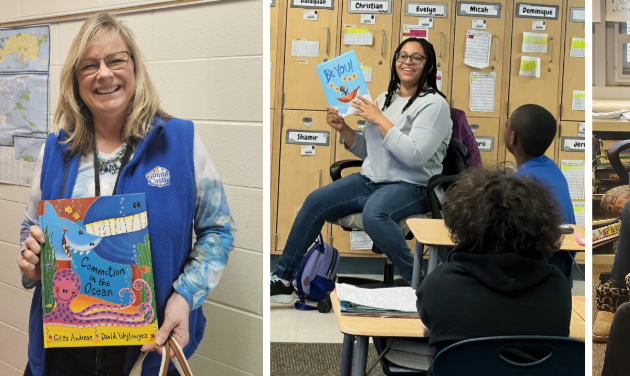

United Way of Central Ohio is a valuable resource for families who need support to claim Child Tax Credits. Our team can help families complete the necessary paperwork as well as help them avoid scams and fraud.

To determine eligibility, families can use this flow chart, which details necessary steps:

https://www.consumerfinance.gov/coronavirus/managing-your-finances/child-tax-credit-flowchart/

For additional resources and specific information concerning the Child Tax Credit, please email taxtime@uwcentralohio.org.